Making sense of your finances with hledger reports

9 July 2025

A beginner’s guide to four essential hledger commands (print, balance, balancesheet and incomestatement) for analysing your accounting or personal finance data.

Since last year, I have been using hledger for tracking my personal finances (having been forced persuaded by my husband to give it a try). I diligently recorded all my transactions, knowing that all my financial data was captured perfectly in plain text. But I didn’t know how to query that data to answer basic questions about my finances. How much have I been spending every month? What’s my net worth now? The data was all there, but I didn’t know how to extract it.

That changed when I recently spent some time building a desktop app for hledger. I dived deep into the reports and options, and found four commands that answer 90% of my financial questions. This guide will show you how to use them to make sense of your finances.

Prerequisites: This guide assumes you already have hledger installed and some transactions recorded in your journal file. We’ll focus purely on querying and analyzing your data.

First up is the print command, a search engine for your transactions. It finds and displays transactions based on your criteria, which can include account names, descriptions, dates and more. Use this to answer transaction-specific questions like “How much was my shopping at H&M and Uniqlo last month?” or “What gifts have I purchased for people this year?”

Queries

Most of the time, you will want to run print with a query, like hledger print <query>.

By default, the query matches account names. Let’s find all my food expenses:

$ hledger print expenses:food

2025-01-03 Supermarket - Cold Storage

liabilities:creditcard:dbs $-95.40

expenses:food:groceries $95.40

2025-01-06 Lunch - Ya Kun Kaya Toast

liabilities:creditcard:dbs $-8.90

expenses:food:eatingout $8.90

You can also search transactions by their description. Just add desc: at the start of the query:

$ hledger print desc:'cold storage'

2025-01-03 Supermarket - Cold Storage

liabilities:creditcard:dbs $-95.40

expenses:food:groceries $95.40

2025-02-04 CNY Groceries - Cold Storage

liabilities:creditcard:dbs $-120.50

expenses:food:groceries $120.50

Other than accounts and descriptions, you can also filter by:

- Date -

date:20250101for a specific date,date:202502for a month. You can do periods using a hyphen likedate:20250401-20250601, specify a start date onlydate:20250401-or end date onlydate:-20250401 - Amount -

amt:100for a specific amount,amt:'>100',amt:'<=10'for greater or less than filters - Currency -

cur:USD,cur:\\$

You can also combine multiple queries for powerful, focused searches. Try hledger print desc:'h&m' desc:uniqlo date:202505 to find all H&M or Uniqlo purchases in May 2025. Or hledger print expenses:gift amt:'>=100' date:2025 to find expensive gifts you purchased this year.

A note about dates

hledger is pretty smart about dates, but one thing that may be confusing is that end dates are exclusive.

date:20250401-20250501means “on or after 1 Apr, and before 1 May”date:20250401-20250430means “on or after 1 Apr, and before 30 Apr”

The first one gives transactions for the whole month of Apr 2025, while the second one only includes transactions until 29 Apr.

When only a month is provided, eg. date:202504, hledger smartly interprets it as a period (the whole month of Apr 2025). But in date:202504-202505, the dates are interpreted as the 1st of each month, resulting in a query “on or after 1 Apr, and before 1 May”. This will give you only Apr transactions.

So print lets you search and filter through your transactions. But what about the big picture?

balance

balance is your financial calculator, summing up account totals. This is a very flexible command, useful for answering “how much?” questions, such as “How much did I spend in total last month?” or “How much is my current net worth?”

💡 Key Insight: Use print when you want to see individual transactions, balance when you want totals.

Run balance (bal for short) without any options, and you’ll see a full list of all your account totals since day one of your journal. This can be a pretty long list!

$ hledger bal

$41,319.40 assets:checking:dbs

$102,600.00 assets:investments:stocks

$82,800.00 assets:savings:dbs

$-145,000.00 equity:openingbalances

$113.80 expenses:education:books

$2,531.90 expenses:entertainment:activities

$216.83 expenses:entertainment:streaming

$12,023.05 expenses:food:eatingout

$4,652.33 expenses:food:groceries

$300.00 expenses:health:dental

... (skipping many more sub-accounts under expenses)

$-12,500.00 income:bonus

$-2,006.20 income:dividends

$-146,600.00 income:salary

$-6,729.46 liabilities:creditcard:citibank

$-8,630.74 liabilities:creditcard:dbs

--------------------

0

Let’s see how we can narrow it down. First, we can use the same queries that we did with print (account, description, date etc) for filtering. For example, hledger bal income will show my income accounts only. To view my total expenses for last month, we would run hledger bal expenses date:202505.

Depth

Instead of seeing every single sub-account and getting information overload, maybe we just want to see our main expenses categories. Use --depth 2 to limit the depth to 2 (expenses and one sub-account):

$ hledger bal expenses date:202505 --depth 2

$189.00 expenses:education

$125.00 expenses:entertainment

$1,684.90 expenses:food

$3.90 expenses:house

$2,318.50 expenses:housing

$280.00 expenses:personal

$190.08 expenses:shopping

$35.40 expenses:tech

$35.88 expenses:transport

$320.07 expenses:travel

--------------------

$5,182.73

That food expense looks high. Do I usually spend that much on food, or is this an outlier? Let’s dig deeper.

Intervals and multi-period reports

Let’s investigate my monthly food expenses. I’ll narrow down the account query to expenses:food, remove the --depth 2, and expand the date range. To compare each month’s data, we can add --monthly:

$ hledger bal expenses:food date:2025-202506 --monthly

Balance changes in 2025-01-01..2025-05-31:

|| Jan Feb Mar Apr May

=========================++=================================================

expenses:food:eatingout || $461.10 $1,257.40 $468.80 $618.85 $1,418.10

expenses:food:groceries || $239.40 $359.10 $283.00 $158.44 $266.80

-------------------------++-------------------------------------------------

|| $700.50 $1,616.50 $751.80 $777.29 $1,684.90

This changes the balance report format to become a multi-period report- a table with accounts as rows and time periods as columns. Pretty cool stuff, useful for seeing trends over time. Here I see that my eating out expenses fluctuates a lot between months.

Other than --monthly, you can also call the balance command with --daily, --weekly, --quarterly, or --yearly to show data for different intervals. Personally, I usually stick to monthly and yearly views. For example, I’ll use hledger bal income --yearly to see my total income for each year.

Tip: use short-form options to save typing

Note: hledger has short forms for many options to make cli commands concise and faster to type. Instead of --depth 2, you can just write -2. Instead of --monthly or the other interval options, you can write -D (daily), -W (weekly), -M (monthly), -Q (quarterly), or -Y (yearly). I’ll use these short forms from here on.

Accumulation modes

Ok, now we know how to query our expenses and income. What about assets and liabilities?

Here’s what confused me at first, running balance with a monthly period on my assets:

$ hledger bal assets date:2025-202506 -M -1

Balance changes in 2025-01-01..2025-05-31:

|| Jan Feb Mar Apr May

========++=======================================================

assets || $4,698.30 $3,102.90 $4,623.60 $5,020.10 $4,843.90

--------++-------------------------------------------------------

|| $4,698.30 $3,102.90 $4,623.60 $5,020.10 $4,843.90

Hmm… that doesn’t seem right. My total assets should be much more than $4k! What is happening?

The header line in this command reveals the issue- this data is showing “Balance changes”. This shows what moved in each month, not what I have.

This brings us to the concept of accumulation modes. When viewing data over multiple periods, hledger can show either:

--change(default): sum up all the amounts for transactions within each period- Good for: Incomes and expenses (“How much did I spend within each month?”)

--historical: sum up amounts as running totals from the start of your journal- Good for: Assets and liabilities (“What was my total wealth each month?”)

💡 Key Insight: incomes and expenses happen within a month (use --change), but assets and liabilities exist at the end of a month (use --historical).

Here’s the same query with both accumulation modes to see the difference:

$ hledger bal assets:checking date:2025-202504 -M --change

Balance changes in 2025Q1:

|| Jan Feb Mar

=====================++================================

assets:checking:dbs || $2,398.30 $-1,497.10 $523.60

---------------------++--------------------------------

|| $2,398.30 $-1,497.10 $523.60

$ hledger bal assets:checking date:2025-202504 -M --historical

Ending balances (historical) in 2025Q1:

|| 2025-01-31 2025-02-28 2025-03-31

=====================++====================================

assets:checking:dbs || $38,928.90 $37,431.80 $37,955.40

---------------------++------------------------------------

|| $38,928.90 $37,431.80 $37,955.40

Notice how --change shows what moved in/out of the account each month, while --historical shows my final account balance at the end of each month.

So to view my total assets every month, I simply need to add the --historical option so that hledger sums up all my assets from the start of my journal data:

$ hledger bal assets date:2025-202506 -M -1 --historical

Ending balances (historical) in 2025-01-01..2025-05-31:

|| 2025-01-31 2025-02-28 2025-03-31 2025-04-30 2025-05-31

========++=================================================================

assets || $209,128.90 $212,231.80 $216,855.40 $221,875.50 $226,719.40

--------++-----------------------------------------------------------------

|| $209,128.90 $212,231.80 $216,855.40 $221,875.50 $226,719.40

While --historical is usually what you want for assets and liabilities, there are times when --change makes sense too, like when you want to see how much your net worth or account balance changed each month rather than the absolute totals.

Whew, that’s a lot to remember. The last two commands I’m going to introduce are much easier, as they are specialized versions of balance.

balancesheet

The first is balancesheet, your net worth calculator. This shows your asset and liability account totals:

$ hledger balancesheet

Balance Sheet 2025-05-31

|| 2025-05-31

=================================++=============

Assets ||

---------------------------------++-------------

assets:checking:dbs || $41,319.40

assets:investments:stocks || $102,600.00

assets:savings:dbs || $82,800.00

---------------------------------++-------------

|| $226,719.40

=================================++=============

Liabilities ||

---------------------------------++-------------

liabilities:creditcard:citibank || $6,729.46

liabilities:creditcard:dbs || $8,630.74

---------------------------------++-------------

|| $15,360.20

=================================++=============

Net: || $211,359.20

Looks familiar? This report shows the same data as hledger bal assets liabilities --historical, but formatted in a nice structured way. The signs for liabilities (usually negative) are flipped to positive to be easier to read.

Since this command is a variation of balance, we can use the same options such as account query, date ranges, depth, and intervals for multi-period reports. For example, here I am looking at my monthly DBS bank accounts and credit card balances (useful for checking against my DBS statement totals):

$ hledger balancesheet date:2025-202504 -M dbs

Monthly Balance Sheet 2025-01-31..2025-03-31

|| 2025-01-31 2025-02-28 2025-03-31

============================++=======================================

Assets ||

----------------------------++---------------------------------------

assets:checking:dbs || $38,928.90 $37,431.80 $37,955.40

assets:savings:dbs || $73,400.00 $75,800.00 $78,100.00

----------------------------++---------------------------------------

|| $112,328.90 $113,231.80 $116,055.40

============================++=======================================

Liabilities ||

----------------------------++---------------------------------------

liabilities:creditcard:dbs || $6,405.85 $7,161.15 $8,387.24

----------------------------++---------------------------------------

|| $6,405.85 $7,161.15 $8,387.24

============================++=======================================

Net: || $105,923.05 $106,070.65 $107,668.16

Conveniently, the balancesheet report uses --historical by default, as that’s usually how we want to see our assets and liabilities. But since we know about accumulation modes, we can also use --change if we want to see the changes in the accounts.

incomestatement

As for incomes and expenses, we can use incomestatement, another variation of balance.

Running incomestatement shows all your income/revenue and expense accounts:

$ hledger incomestatement

Income Statement 2024-01-01..2025-05-31

|| 2024-01-01..2025-05-31

===================================++========================

Revenues ||

-----------------------------------++------------------------

income:bonus || $12,500.00

income:dividends || $2,006.20

income:salary || $146,600.00

-----------------------------------++------------------------

|| $161,106.20

===================================++========================

Expenses ||

-----------------------------------++------------------------

expenses:education:books || $113.80

expenses:education:courses || $2,733.90

expenses:entertainment:activities || $2,531.90

expenses:entertainment:movies || $432.00

expenses:entertainment:music || $12.98

expenses:entertainment:streaming || $216.83

expenses:food:eatingout || $12,023.05

... (skipping many more expenses sub-accounts)

expenses:travel:transport || $33.40

-----------------------------------++------------------------

|| $94,747.00

===================================++========================

Net: || $66,359.20

This shows the same data as hledger bal revenues income expenses, but with nicer formatting and revenue/income signs flipped to positive.

This defaults to using --change mode, because for incomes and expenses, we usually want to see changes within a period. Hence, we can easily see a breakdown of our monthly incomes and expenses:

$ hledger incomestatement date:2025-202504 -M -2

Monthly Income Statement 2025Q1

|| Jan Feb Mar

========================++=================================

Revenues ||

------------------------++---------------------------------

income:dividends || $156.90 $98.70 $112.50

income:salary || $8,800.00 $8,800.00 $8,800.00

------------------------++---------------------------------

|| $8,956.90 $8,898.70 $8,912.50

========================++=================================

Expenses ||

------------------------++---------------------------------

expenses:education || $228.99 $119.99 $268.99

expenses:entertainment || $167.00 $309.88 $167.00

expenses:food || $700.50 $1,616.50 $751.80

expenses:health || $723.50 $388.50 $553.50

expenses:housing || $2,308.60 $2,295.80 $2,298.90

expenses:personal || $189.00 $480.00 $350.00

expenses:shopping || $659.50 $1,145.60 $870.60

expenses:tech || $399.00 $189.00 $599.00

expenses:transport || $42.60 $114.50 $48.90

------------------------++---------------------------------

|| $5,418.69 $6,659.77 $5,908.69

========================++=================================

Net: || $3,538.21 $2,238.93 $3,003.81

What’s next?

These four commands (print, balance, balancesheet, and incomestatement) are what I use for 90% of my financial analysis needs. Start analysing your own data to find out:

- What’s the breakdown of my expenses for last month? (

hledger bal expenses date:202505 -2) - What large purchases did I make on Amazon this year? (

hledger print desc:amazon amt:'>100' date:2025) - How has my net worth changed over the years? (

hledger balancesheet -Y)

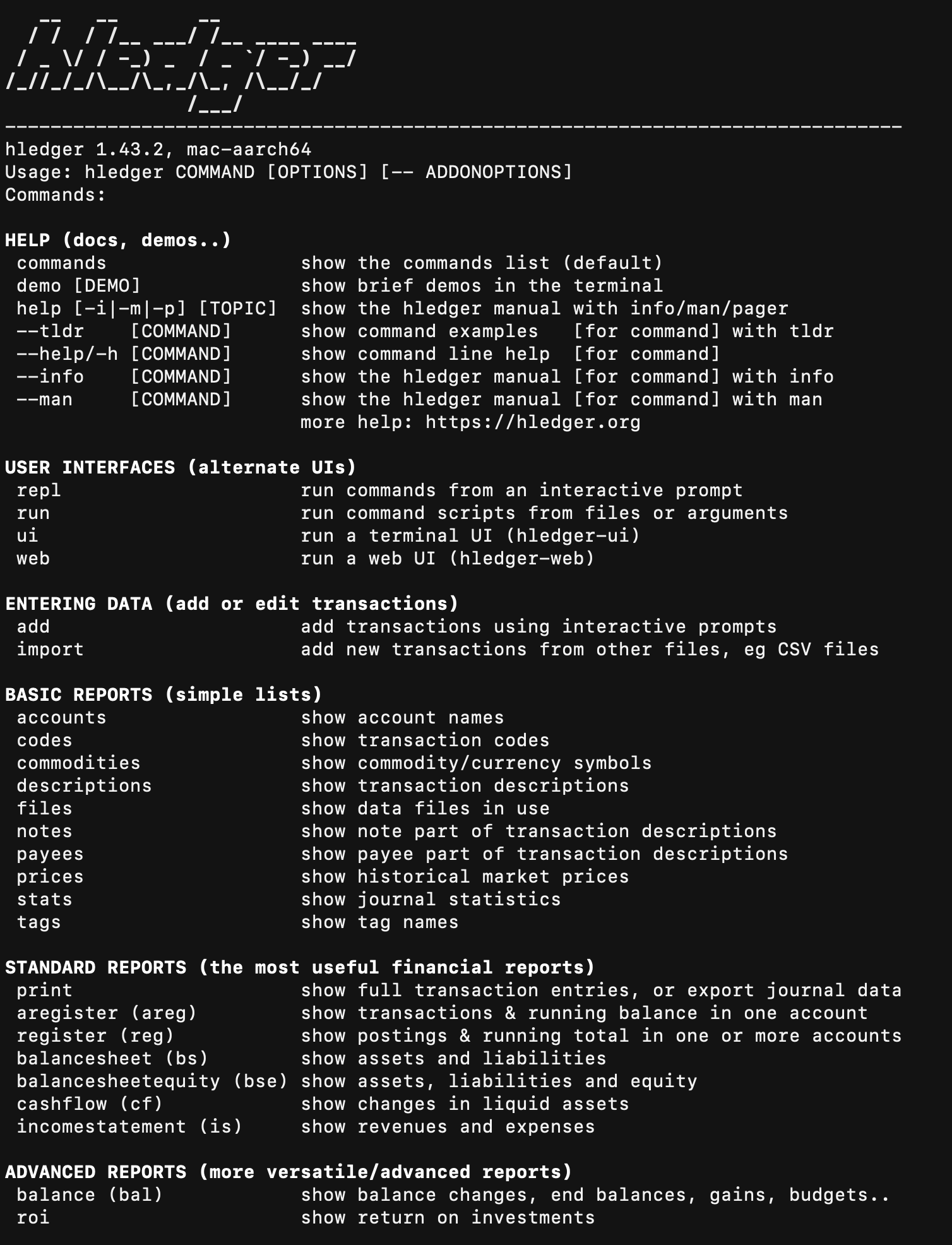

hledger has many more commands, and the options that we’ve learnt are just scratching the surface. For more advanced features, explore the hledger manual.

Remember, you can always run hledger <command> --help to view the options for that command. Or run hledger alone to get a summary of all the available commands and reports. Happy exploring!